tax act online stimulus check

All the latest news and updates on the fourth stimulus check Child Tax Credit expansion and the 2022 COLA Social Security boost for recipients. 1 online tax filing solution for self-employed.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Our tax preparation software offers easy guidance and ensures your maximum tax refund.

. Read the entire 13MB 5592 page PDF File of the COVID-related Tax Relief Act of 2020 as passed by Congress. Keep in mind that you must file your taxes to quality for the stimulus check. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Check the status of your third stimulus payments as the IRS Get My Payment tool will only show the status of the most recent. The claim appeared elsewhere on Facebook as well as on Twitter. However the prepayment will be based on the most recent information between 2019 and 2020 that is on the IRSs systems at the time of payment in late March.

But the 19 trillion stimulus package aimed at addressing the impact of the Covid-19 pandemic which President Joe Biden signed into law on March 11 did not institute a new tax on transactions through apps or online payment services. According to the IRS nearly 90 of children in the US. As part of changes from the March 2021 stimulus bill the value of the credit as well as the age limit have increased.

The Build Back Better Act which was passed in the House of Representatives and is awaiting action in the Senate would extend the payments as well as other child tax credit enhancements for one. But there is one huge difference between the advance payment of a taxpayers 2021 Child Tax Credit and any stimulus check a client receives. When the Tax Cuts and Jobs Act doubled the credit amount per qualifying child from 1000 to 2000 however.

It is essentially an advance payment of a refundable tax credit and its calculated using the most recent tax data the IRS has on file for each. What is an Economic Impact Payment EIP. Online competitor data is extrapolated from press releases and SEC filings.

The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance. Self-Employed defined as a return with a Schedule CC-EZ tax form. 600 stimulus checks with 600 for each eligible dependent were sent out as a part of the Coronavirus.

If the advance of a taxpayers 2021 Child Tax Credit amount exceeds their actual 2021 Child Tax Credit amount. If you are the recipient of Social Security Income and do not report any other taxable income learn how to claim Stimulus 1 and 2. Based on the new rules half of the credit was distributed in advance over six months in 2021.

1 online tax filing solution for self-employed. This newest round of stimulus payments EIP 3 will be reconciled on the 2021 tax return. The American Rescue Plan ARP does not impact.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Latest news on President Bidens Build Back Better bill plus updates on a fourth stimulus check the Child Tax Credit and Social Security COLA. E-file your federal and state tax returns with TaxAct.

An Economic Impact Payment or EIP is a stimulus payment provided to taxpayers most recently for COVID-19 relief. The IRS has extended the usual April 15 deadline to July 15. The CTC is now fully refundable which means you can receive the credit even if you dont owe the IRS.

If your 2020 federal income tax return is on file by the time the IRS processes your stimulus check the amount of your payment will be calculated based on that reduced income. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e. Over the last year there have been three separate stimulus bills passed to help those financially impacted by coronavirus.

Tax Day has been delayed this year but if youre one of the millions of people missing stimulus check money from the first two payments nows the time to file for a Recovery Rebate Credit on. It was part of the CARES Act Coronavirus stimulus package which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. Updated for filing 2021 tax returns.

Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e. 1200 stimulus checks with 500 for each eligible dependent were sent out as a part of the CARES Act Jan 2021. Online competitor data is extrapolated from press releases and SEC filings.

However if your income increased in 2020 it may be in your best interest to wait to file your taxes until after your stimulus payment arrives. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

You Might Qualify For A 1 400 Stimulus Check And Not Even Know It Bgr

/cdn.vox-cdn.com/uploads/chorus_asset/file/22653418/AP21084015930007.jpg)

Stimulus Check Update Why You Might Get A Check In July Deseret News

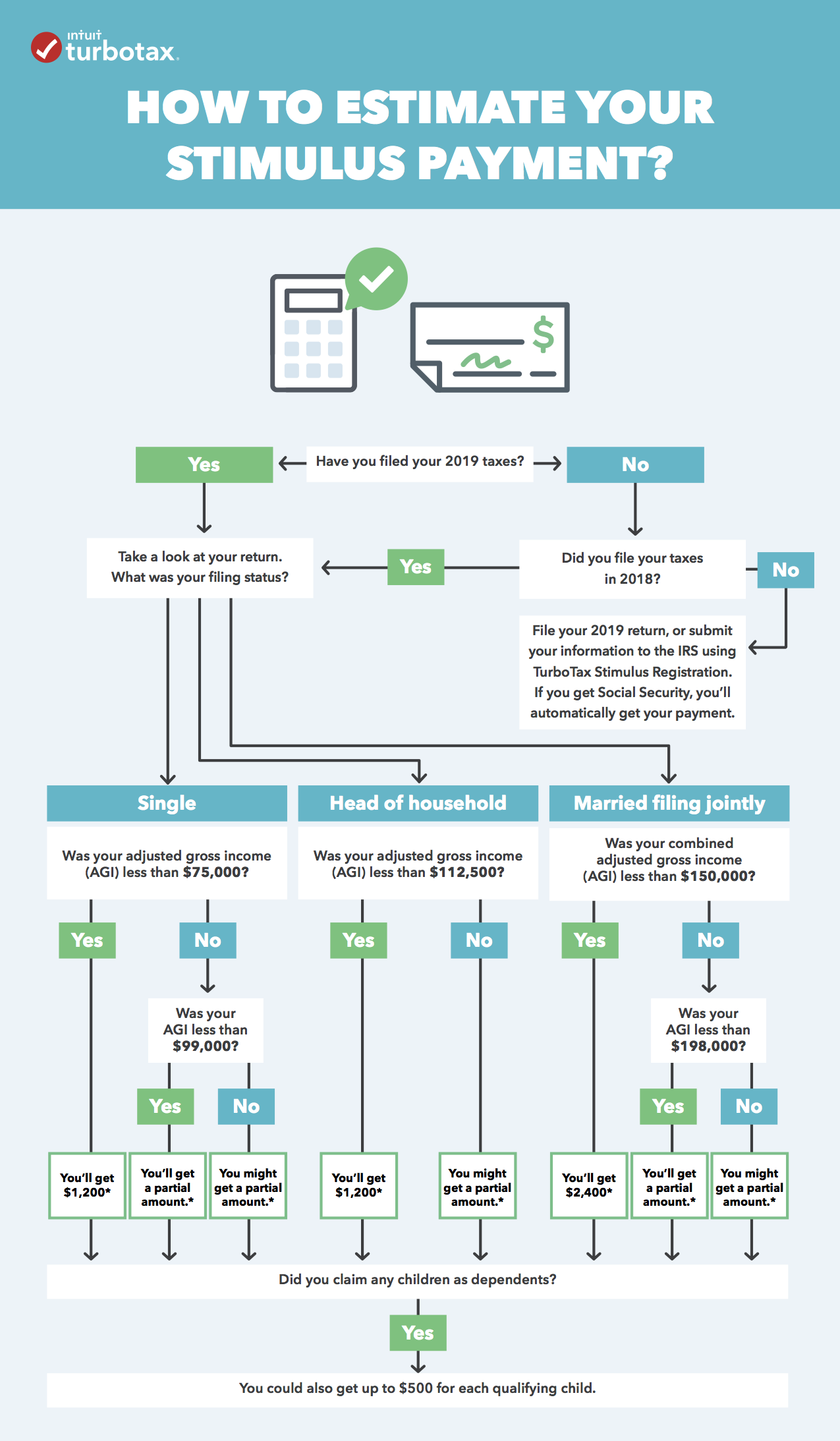

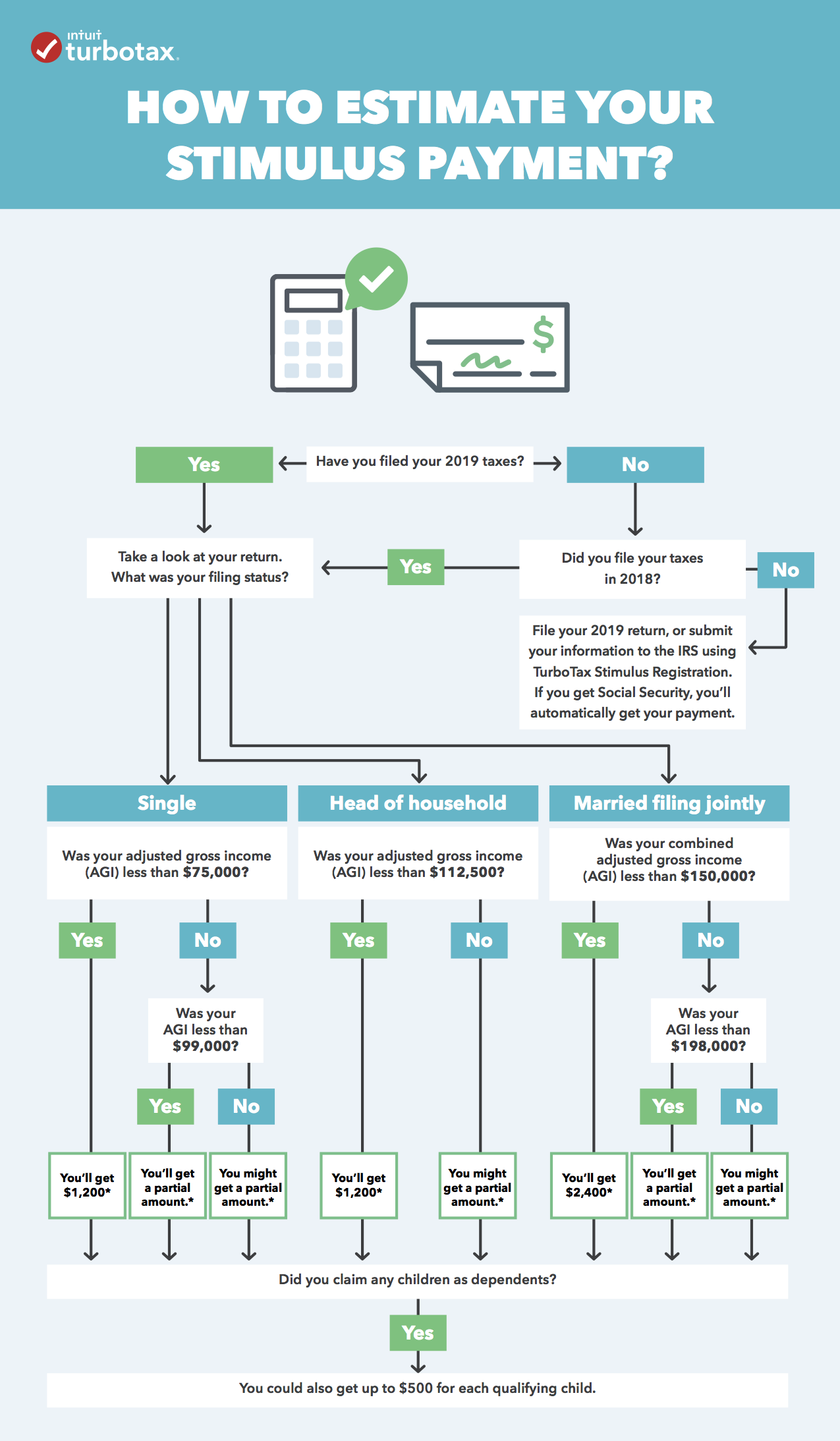

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Stimulus Check Update The 2021 Deadline To Get Your Plus Up Payments Is Quickly Approaching Pennlive Com

Stimulus Registration Economic Impact Payments Taxact

Where To Add Your Stimulus Money On Your Tax Return Taxact

How To Claim Missing Stimulus Payments On Your 2020 Tax Return